Non-Pecuniary Preferences, Adverse Selection, and Moral Hazard in P2P Lending: Evidence from Lending Club

Apr 30, 2024· ,,,·

0 min read

,,,·

0 min read

Dongjie Oliver Fang

Zong-Wei Yeh

Chien-Hsiu Lin

Shih-Kuei Lin

Source from: Fang et al. (2024)

Source from: Fang et al. (2024)Abstract

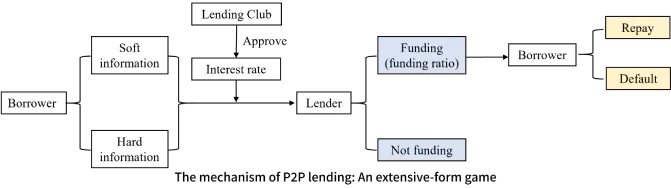

This paper investigates the non-pecuniary preferences of investors on P2P lending platforms, including pro-environmental and prosocial preferences. We capture these characteristics and writing styles from loan descriptions by text mining approaches and analyze their impacts on funding success and default. Our results show that the lenders on Lending Club do not have non-pecuniary preferences or even avoid investing in pro-environmental and prosocial loans. However, the absence of such preferences leads them into the trap of adverse selection since these loans have lower default probabilities. Furthermore, the negative descriptions of loans can also lead to adverse selection among investors, while borrowers’ fraudulent content in descriptions will expose investors to moral hazard.

Type

Publication

Presented at 2024 EFMA, 2024 Eastern FA, and 2023 TRIA