Post-Earnings Announcement Drift, Systemic Shock, and Limited Attention: Evidence from COVID-19 Pandemic

Source from: Fang (2024)

Source from: Fang (2024)Abstract

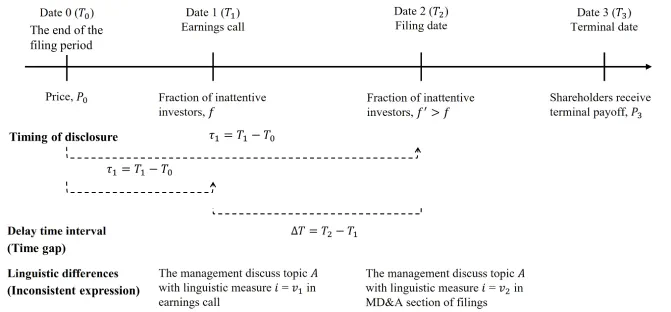

This paper examines the post-earnings announcement drift (PEAD) under the systemic shock by taking the COVID-19 pandemic as an example. Though much prior literature has proved the decline of PEAD, I find this anomaly still existed during the global pandemic. Based on the limited attention theory, I investigate the cause of such a phenomenon. From the perspective of signaling, the empirical results show that the broad disclosure of unexpected systemic shock leads to a stronger PEAD. However, firms with negative disclosure about COVID-19 have weaker PEAD due to the negative bias. On the other hand, I find that a later convening of the earnings conference, a larger time gap, and more inconsistent emotional expressions between the earnings call and Forms 10-K & 10-Q strengthen the PEAD by increasing the investors’ information processing cost.

Type

This solo paper is the second paper of my Ph.D. Dissertation “Two Essays on Financial Information Disclosure”.